Many citizens agree with the basic principle of progressive taxes: If you have more, you need to contribute more to the community that is the foundation of your affluence.

But some say that the U.S. income tax is regressive in the sense that, in a practical sense, people who make less money pay a higher percentage of their income in taxes to the government than do the rich. As a result, it sometimes takes an effort to reduce the degeneracy of the tax law or to make it a little more progressive and fair. Here are some pros and cons of a progressive tax and a description of it.

What is a progressive tax?

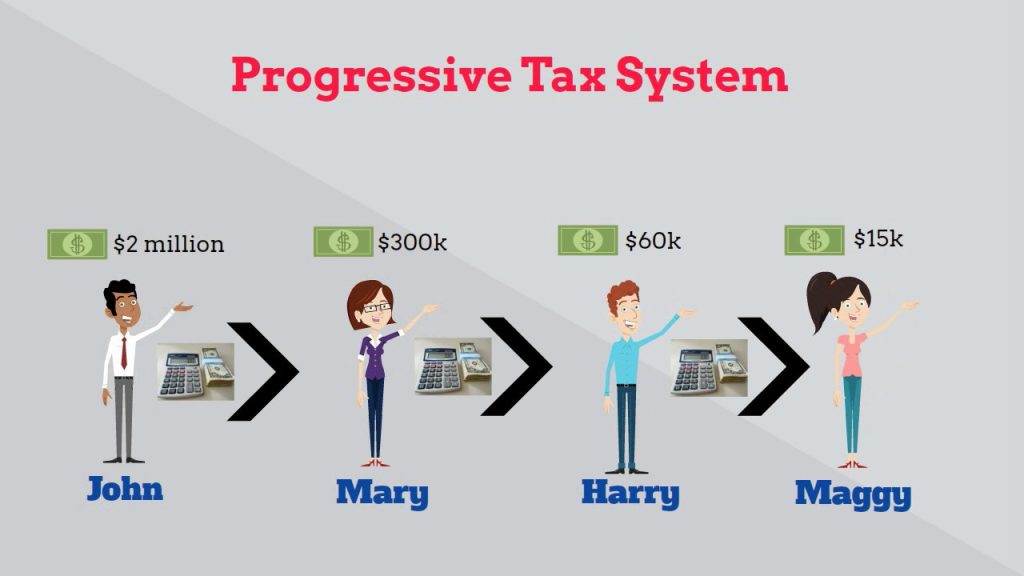

A progressive tax is a tax that increases the average tax burden based on income. High-income families bear a disproportionately large portion of the tax burden, while low- and middle-income taxpayers bear a relatively small tax burden.

The various methods of taxation available to the government include progressive, regressive, assimilative, or proportional. A progressive tax system is one in which the greater the increase in tax income, the greater the tax burden. There may be a minimum tax-free amount that individuals earning less than the specified minimum taxable amount are not responsible for paying to the tax authority.

A deeper definition.

A progressive tax is a function of total tax revenues, which usually refer to income taxes and related deductions and tax credits. In these systems, taxes imposed on individuals are gradually raised or lowered depending on the taxpayer’s income, and deductions and deductions help offset taxes even more.

Progressive taxes relieve low-income people of the burden of paying for what society needs to function, such as roads, schools, or other public services. This helps reduce the impact of income inequality by ensuring that those who earn more invest more, while those who earn less still retain a larger percentage of their income while consuming the same services.

For U.S. taxpayers, the progressive tax system consists of taxing every dollar of income that falls within a certain range called the marginal tax rate, and all income above that range is classified as a higher tax rate. As of 2017, the highest personal income tax rate is 39.6 percent and the lowest is 10 percent, and for married taxpayers who report jointly, the tax rate remains the same, but the income threshold is higher, promising potentially lower tax liability. The income range of each tax tier is adjusted annually in line with inflation.

This is the advantage of a progressive tax.

On the other hand, progressive taxation reduces the tax burden of those who can’t afford to pay the most. This will leave more money in Australian money for low-wage workers, who are likely to spend all that money on necessities and stimulate the economy in the process.

Progressive tax systems also tend to collect more taxes than fixed or regressive taxes because the highest percentage of taxes are collected at the highest amount.

Progressive taxes also require the people with the most resources to support more services that all citizens and businesses rely on, such as road maintenance and public safety.

Shifting more of the tax burden to the rich.

Progressive taxes shift more of the tax burden to wealthy taxpayers. The more progressive the tax measures, the greater the tax burden, and the wealthy get their fair share of the tax burden.

The tax burden is proportional to income.

A progressive tax is a reasonable alternative to a flat tax rate, which places a disproportionate burden on low-income taxpayers. Under a first-class tax system, the amount of dollars lost by low-income workers may be less, but the negative impact of taxes on family purchasing power is greater.

This is the disadvantage of a progressive tax.

Those who criticize progressive taxes see progressive taxes as a disincentive to success. They also oppose the system as a means of income redistribution, believing that it unfairly penalizes the rich and even the middle class.

Those who oppose progressive taxes tend to be those who support lower taxes and an appropriate minimum of government services.

Those with high incomes lose motivation.

For some, progressive taxes serve as a disincentive to obtain higher-paying jobs. For example, some retirees may choose lower-paying jobs to keep their tax rates from changing.

Some economists have studied whether this motivation can be weakened. For example, the Raper curve, the theory of supply-side economist Arthur Raper, shows the relationship between tax rates and the amount of tax revenue collected by the government. This curve shows the point at which a decrease in the tax rate can increase tax revenues.

Income redistribution punishes the rich.

In fact, a progressive tax redistributes money from the rich to the poor because it funds subsidies that benefit the poor. Some economists say a better approach is to use tax revenues for projects that can lead to better jobs for the poor, such as public works and education.

Low-income workers lose motivation.

Taxing high-income citizens and redistributing property to low-wage workers may discourage low-skilled workers from entering the labor market or getting better-paying jobs. According to some economists, this eliminates the need to work hard, learn new skills, or find new ways to earn higher incomes.

Progressive taxes apply different tax rates to different income levels. With progressive taxation, the higher the income, the greater the tax burden. Like other tax systems, progressive taxes have their pros and cons.

GIPHY App Key not set. Please check settings