The word “equity” is often associated with financial tycoons, actors, and professional athletes. Type in a celebrity’s name, and “equity” is almost always included in a suggested Internet search. But it’s not just the rich and famous who can learn to calculate their net worth.

Experts say we should all be aware of our own equity and take care of it. Grant Sabaty, founder of personal finance website Millennial Money and author of Financial Freedom, says it’s “the most important number in personal finance.”

What is my net worth?

To calculate your net worth, make a list of what you own and your outstanding liabilities. And when we say what we own, we mean assets such as cars or houses that you may still be paying for.

For example, if you have a mortgage on a house with a market value of $200,000 and a loan balance of $150,000, you can add $50,000 to your equity.

Basically, the formula is this:

Sum of assets less liabilities equals net assets.

How do I calculate equity?

The first step in calculating net worth is to add up assets and liabilities. Assets include everything you are worth owning, and liabilities include everything you have lost. After adding up assets and liabilities, follow the following basic formula:

Assets-Liability = Net Assets.

The easiest way to calculate equity is to use the Personal Capital equity calculator. If you sign up for a free account, you can link all your financial accounts at any time to check your current equity.

Why is personal equity important?

“Knowing your equity is the foundation of your overall financial plan,” Sokunbi said. “It says. “If you don’t know your equity, it’s like driving a car without knowing where you’re going or where you’re going.

For example, if you estimate your retirement expenses and determine that you need about $1 million to retire comfortably, counting your equity will help you better understand where you are in relation to your goals and whether you are making enough progress to achieve your goals.

According to Sokunbi, when applying for a loan, your equity can also affect your creditworthiness. Is there another reason to know how to calculate your equity? It’s a clear way to track debt reduction and savings growth in one figure, making it easier to assess your overall financial progress.

Sabatier says that if you don’t learn how to calculate your net worth, you will be “acting blind,” which will make it much more difficult to achieve your financial goals.

So, how do I calculate my net worth? It’s not as hard as you might think.

I calculate my own equity. What are assets and liabilities?

If you’re not sure what your assets and liabilities are, check out some guidelines:

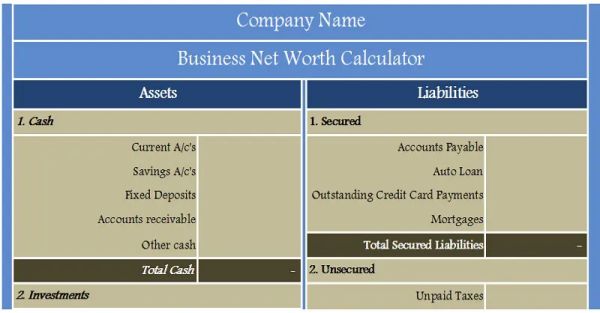

Assets: Assets include cash, such as current accounts, savings and retirement accounts, as well as items such as cars, real estate and investments that can be sold for cash. This is often referred to as a liquid asset.

Some fixed assets may also be included in the net worth calculation if they can be sold or resold as needed. For example, if you are willing to use it for your home equity line of credit or sell it as needed, your home will be reflected in your equity.

Debt: Money you owe to other people or organizations falls into this category. This includes revolving consumer debt, such as credit card balances, as well as balances on personal loans, automobiles, payday loans, and title loans. If you use your home as an asset, the mortgage is also considered debt.

How to use the Net Worth Calculator

To get the most out of the Forbes Advisor net worth calculator, we recommend that you enter data that accurately reflects the value of your assets and liabilities.

Figure out your assets.

To accurately determine your net worth with this calculator, you need to know the value of your primary asset well.

Assets are nothing more than assets that can be exchanged for cash. Stocks, bonds, and other investments are assets, but things like houses, cars, and even money in current accounts are assets.

Because some assets are more liquid than others, they can be sold more quickly at prices that reflect their current value. For example, cash is the most liquid asset. However, because other assets have low liquidity, it takes time and effort to sell, and they may not be exactly what you thought they were worth.

For each asset type in the calculator, enter an estimate of how much you think the asset would be worth if you sold it today. Don’t worry about how much you would be owed for something like a car loan or a mortgage. We’ll look at that in the “Your Debt” section.

Annual Growth Rate of Assets.

It can be very difficult to correctly determine the annual growth rate of an asset. Our calculator allows you to tabulate the value of four types of assets: real estate, personal property, investments and cash.

Each is likely to get a very different annual return, and so it will be difficult to accurately determine the total annual growth rate. This calculator sets the default growth rate at 7% to reflect the somewhat conservative returns of equity and real estate investments. If you have a significant amount of cash or personal property that has a low or no return, you can lower it even more.

Understand your debt.

Debt is the negative aspect of your personal balance sheet or unrealized financial debt that you have lost. All you have to do is enter the unpaid amount for each type of debt into our calculator.

Over time, some liabilities gradually turn into assets. If you pay off your mortgage and earn equity in your home, that’s it. In other cases, paying off debt simply means that the entity that borrowed the money no longer has obligations, such as reducing the credit card balance.

Annual Growth Rate of Debt.

The annual growth rate of debt can be as difficult to determine as the growth rate of assets.

For some debts, such as auto loans or mortgages, there are already agreed-upon terms and interest rates. Other debts, such as student loans and credit card debt, are more open-ended. If you keep topping up your balance or making minimum regular payments, your debt may continue to grow.

If you have a mortgage and a car loan, and each one is regularly repaid (depending on the terms of the loan agreement), the increase in debt should be zero. If you have a credit card balance that you don’t top up and you pay off each month, the rate of increase in debt should also be zero.

However, if you have student loan or credit card debt that you don’t pay off regularly, think about the interest rate and balance you should enter to approximate what the increase in debt will be.

GIPHY App Key not set. Please check settings