The secured loan (LTV) determines the maximum amount of the secured loan based on the market capitalization of the asset held as collateral. (In the case of a secured loan, if the borrower fails to repay the loan, the borrower has a claim on the asset).

The market value of an asset is the typical price paid for the asset in the open market between two unrelated parties. Larger loans can be made if the assets provided as collateral are relatively easy to convert into cash (i.e., Extremely illiquid assets).

What is the mortgage-to-value ratio?

The mortgage rate on a loan refers to how much money you borrow compared to the value of the assets that are the collateral for the loan. For a mortgage loan, compare the loan balance to the value of the house. For car loans, the loan balance is compared to the value of the car.

Borrowers use LTV as a way to measure credit risk. The lower the LTV of the loan, the less risk the borrower assumes. If you foreclose on a borrower without paying, a low LTV means that the borrower is more likely to fully recover his or her losses by selling the foreclosed assets. The higher the LTV, the greater the risk that the borrower will suffer some loss.

Borrowers may have a maximum LTV that they can approve. For example, an FHA loan requires at least 96.5% LTV. Conventional loans require a minimum 97% LTV, but most eligible borrowers require a minimum 95% LTV. The LTV of a loan can have other important implications for loan terms, including interest rates and monthly payments.

Understand the loan-to-value (LTV) ratio.

Determining the LTV ratio is an important factor in getting a mortgage loan. You can use it to buy a home, refinance your current mortgage into a new loan, or borrow against accumulated equity in your property.

Borrowers evaluate the LTV ratio to determine the level of exposure they are taking when they apply for a secured loan. When a borrower requests a loan for an amount that is close to the appraised amount (and therefore has a higher LTV ratio), the borrower understands that the loan is more likely to result in default. This is because there is very little capital accumulated in the property.

As a result, in the event of a foreclosure, the borrower may have difficulty selling the house at a price sufficient to cover the balance of the mortgage, and still be able to profit from the transaction.

How do I calculate the interest on secured loans?

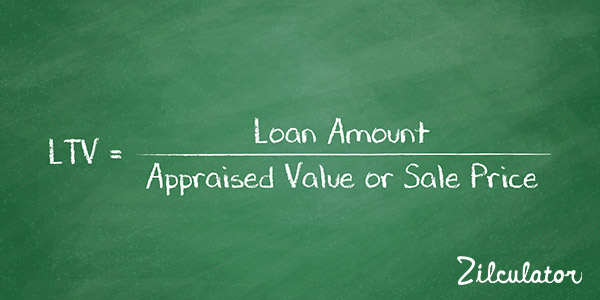

To get the LTV ratio, divide the loan amount by the valuation of the secured asset.

For example, suppose you want to buy a cigar house for $100,000. I have $20,000 as a down payment, so I have to borrow $80,000.

Your LTV ratio would be 80%. Because the dollar amount of the loan is 80% of the value of the house, and the value of $80,000 divided by $100,000 is 0.80 or 80%.

An acceptable LTV ratio.

The magic number for mortgage loans is usually around 80%. Generally, if you get a loan for at least 80% of the value of the home, you must take out Personal Mortgage Insurance (PMI) to protect the borrower. This is an additional cost, but you can often cancel your insurance once it is less than 80%.

Another notable figure is 97%. Some lenders can buy at a discounted rate of 3% (FHA loans are 3.5%), but they will pay the mortgage insurance for the life of the loan.

LTV rates are often higher with auto loans, but borrowers can set limits or maximums and change your interest rates depending on how high your LTV rate is. Even loans above 100% LTV are available because the value of a car can fall more sharply than other types of assets.

When you get a mortgage loan, you take advantage of the value of your home and effectively increase your LTV rate. LTV decreases when the value goes up because the price of the house goes up, but you may need an appraisal to prove it.

How can I raise my mortgage rate?

You can pay off debt to raise the rate on a secured loan. “There’s always a way to pay the prepayment with excess money,” Lemay said. “I said: “Oh, my goodness.”

But focusing on raising mortgage rates isn’t always the most profitable strategy for companies.

“Growing companies can get more by continuing to invest up to a certain point to get the benefits of leverage. For example, you can borrow again to acquire competitors to continue to grow. This transaction will strengthen its position in the market.”

To determine whether the mortgage cost ratio should be higher or lower, you need to look at where it is in the corporate life cycle

How does LTV affect mortgage rates?

Borrowers use LTV as a way to measure credit risk. The higher the LTV of a loan, the higher the risk.

Borrowers compensate for risk in several ways.

One is that they tend to charge higher interest rates on riskier loans. If you apply for a loan with a high LTV, you expect to get a higher interest rate than if you were willing to pay more down payments. Higher interest rates increase your monthly payments and the total cost of your loan.

Another is that borrowers may charge extra fees for borrowers who apply for riskier loans. For example, you may have to pay more points to get a lower rate, or the lender may charge a higher fee. The more down payments, the lower the prepayment fee.

One of the biggest factors affecting the LTV ratio on secured loans is personal secured loan insurance. PMI does not affect the interest rate on the loan, but it is an additional cost that you must pay. Many lenders will allow borrowers to pay PMI until the borrower’s LTV reaches 80%.

PMI can cost up to 2% of the cost of the loan each year. Especially if there are many secured loans, adding it to the loan can be expensive.

GIPHY App Key not set. Please check settings