Interest rates and credit cards have a strong and explosive relationship in the U.S. economy.

Interest rates are the economic fuel that greatly increases card companies’ profits. It allows them to extend credit almost involuntarily every day to the 199 million Americans who have at least one credit card.

The interest rate is also the price consumers pay for the privilege of borrowing money, and there are limits on spending. And shop whenever you feel like it.

These two factors can be a dangerous combination.

Credit card debt plummeted in the two years since September 2008, thanks to the Great Depression. Since then, card debt has risen steadily, reaching $1.27 trillion, the highest in the history of the Federal Reserve in March 2018.

Card companies are making significant amounts of money from interest on unpaid balances. Visa, the largest card company, reported revenues of $18.36 billion in 2017, a 51.87 percent return, the highest ever. Mastercard, the next largest credit card company, reported a 41.68% yield on revenue of $12.5 billion.

In 2017, the average interest rate on these unpaid balances was 16.73%, but cardholders who don’t pay off their balances at the end of each month will get an interest rate of over 25%.

So obviously, if you use a credit card and don’t pay off your balance at the end of each month, you should find out how the interest rate works and how it affects your account.

What is Credit Card Interest?

Credit card interest is a constant charge that accrues on your credit card balance, but is usually presented by the publisher as an annual percentage rate. The APR, that is, the annual percentage rate, simply refers to the annual percentage rate.

You can find the interest rate assigned in the Credit Card Terms and Conditions. It is often a variable interest rate, which means that it can fluctuate based on fluctuations in the federal interest rate. However, the Credit Card Act of 2009 prohibits issuers from raising rates without notice.

Credit card interest does not accrue immediately. Interest will accrue on the balance remaining after the due date of the credit card statement. This means that from the end of the payment cycle until the expiration date (aka grace period), you have time to pay your bill without interest charges.

That’s why consumers with good credit habits shouldn’t automatically fear high interest rates, says John Ulzheimer, a former credit expert at FICO and Equifax. “If they plan to pay off the balance every month, the APR doesn’t matter. Because they’ll never have a balance that’s covered by APR.

How is credit card interest calculated?

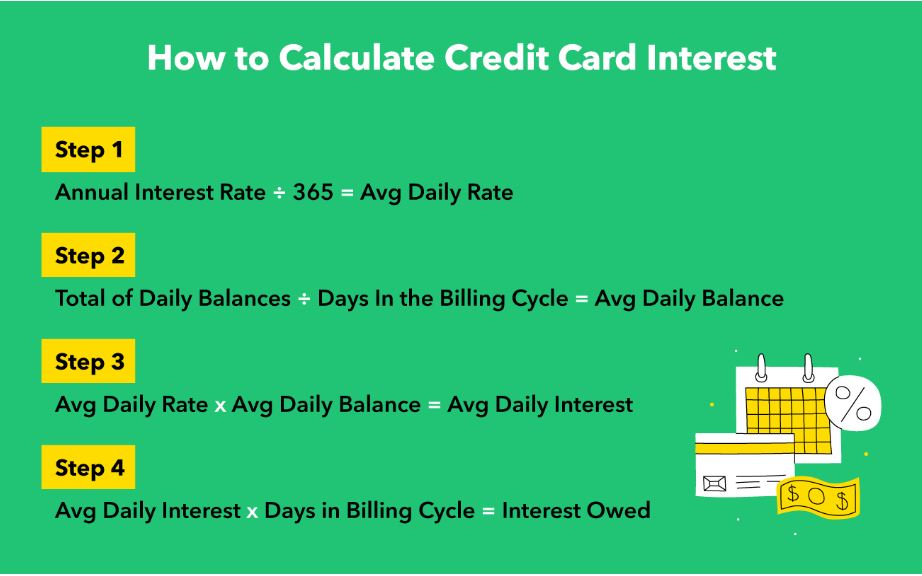

Card companies use your daily regular interest rate and average daily account balance to calculate your daily interest rate.

By taking the interest rate and dividing it by 365, you can determine the daily recurring rate on your credit card. For example, if your credit card interest rate is 23%, your daily recurring interest rate would be 0.000630%.

The average daily balance on your credit card is the average debt you owe on your credit card throughout your payment cycle. You can use your statements to track your daily spending, find your daily balance, and then add them up and divide by the number of days in your payment cycle.

Once you get both numbers, you can multiply them to find the daily interest rate. To find the interest rates for each pay cycle, multiply the number of days in the pay cycle by the daily interest rate.

For example, the average daily balance is $1,000 and the daily cycle is $1,000.Think of someone who is 000630%. They get interest of $0.63 per day. For a 30-day payment cycle, this would add an interest charge of $18.90 to their bill.

As the interest continues to accumulate throughout the month, the new interest accumulates not only on the existing balance, but also on the new additional interest charges. Daily interest and these cumulative effects play a big part in why credit cards can become so expensive so quickly, and the sooner you pay off some of your balance, the better.

Factors that determine interest rates

Interest rates can be any size, but credit cards usually fall into one of three categories: variable interest rates, fixed interest rates, and preferential interest rates. Most companies issue cards that are linked to revolving credit. Users of these cards can roll over their account balances at the end of the payment cycle. Cardholders who have balances will earn interest on their next accounts:

There are several factors that affect the interest rates charged on each card by the four major credit card companies: Visa, MasterCard, American Express and Discover.

Among the factors:

- Current interest rate – Also known as the “prime interest rate,” this interest rate is the basis for most credit card interest rates. Prime interest rates have been in effect for years, but in December 2015, they went up 0.25% and card interest rates went up at the same time. Cardholders were paying $192 million more in interest each month based on the slight change in the prime rate.

- Your credit history and card issuer risk score – The credit card company will look at both your credit report and your credit rating to help you determine the interest rate you will be charged. A high credit score means low interest rates, and vice versa.

- Apply different interest rates – Generally, the term for interest rates is APR (or annual percentage rate), but multiple APRs can be attached to one card. Different APR rates may apply to purchases, cash advances, balance transfers, and promotional rates. Some cards have an APR that changes after 6 months or a year. Most have a variable APR, but some are fixed.

- Promotional Offers – Card companies lure consumers with 0% incentives. Sometimes for more than a year. At the end of the promotional period, fees go up.

- Payment history – If a payment is late or you don’t pay everything, the card company sometimes raises your interest rate dramatically.

How to avoid credit card interest

The best way to avoid credit card interest entirely is to pay your balance in full before your credit card payment is due. If you can avoid balancing, your APR is “meaningless,” Ulzheimer says.

It takes good credit habits, such as paying on time, monitoring your account regularly and making sure you’re not overspending. If you’re worried about not being able to pay the fee, you can use it only for scheduled purchases and plan to use the card only when you have cash to pay the full fee.

There are also credit cards that offer 0% APR, at least for a limited period of time. Some offer 0% introductory interest on new purchases, allowing you to finance large planned purchases that will be paid off over an extended period of time. Others offer 0% interest on balance transfers, which is a good way to get rid of existing debt balances. The terms and conditions of these benefits can vary, and many 0% interest credit cards even provide reimbursement for your spending.

GIPHY App Key not set. Please check settings