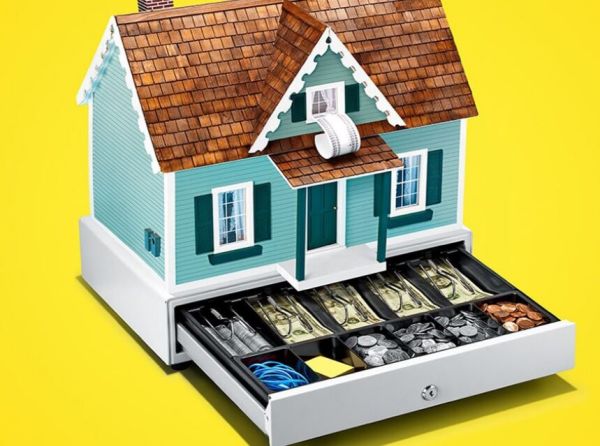

For many people, home equity is their most valuable asset. In most cases, equity is built up over time as the value of the home increases or increases in value through improvements, mortgage repayments. Here’s how equity works.

Equity is the value minus the amount you lost when you took out an equity loan or mortgage. When you first buy a house, your home ownership is like a down payment. If you buy a home for $25,000 with a down payment of $25,000, you start with $25,000 of home equity. After you buy a home, the value of your home equity may change and hopefully it will increase.

What is housing equity?

Housing equity is the value of a homeowner’s financial interest in a home. In other words, the amount of liens placed on the property is deducted from the current market value of the actual property.

The amount of equity in a home fluctuates over time, with increased mortgage payments and market forces affecting the current value of the property.

Home equity can be more than the mortgage is paid off. It is an asset that homeowners can borrow to meet important financial needs, such as paying off expensive debts or paying for college tuition.

Mortgage rates tend to be lower than credit cards or personal loans because the funds are backed by equity. Thus, the equity in your home can be a reasonable source of financing. Also, if the funds are used for home improvements, the interest on such loans is usually tax-free.

How can your home equity increase?

One way to increase your home equity is to pay off your home equity loan. Part of this repayment is used to pay off the principal, which is the money you owe on your home.

In the early years of home ownership, a larger portion of your monthly bill is used to pay off interest than it is to pay off the principal. This means that your mortgage is likely to make only a small contribution to your home equity. You can build up your equity faster by paying more each month than you need to, paying off an extra mortgage each year, or paying it off in a week. Because the loan is paid off faster, making extra payments also helps save interest.

Another way to increase housing equity is when home values in your community go up. If the price of the surrounding home goes up, the value of the home itself also goes up.

For example, if you bought a home for $250,000 five years ago and the fair market value of your current home is $300,000, that extra $50,000 will be part of your home’s assets. This is a good thing because rising home prices can help increase home equity.

Remember that when home prices fall in your area, the amount of your home equity may fall. If the fair market value of your home drops from $300,000 to $280,000, your equity drops to $20,000.

That’s when you pay your mortgage.

The easiest way to increase the equity in your home is to reduce the balance on your mortgage. When you pay off your mortgage on a regular basis each month, you pay off your mortgage balance and increase your home equity. You can also pay off additional principal on your secured loans to build equity faster.

How can I calculate your home equity?

To calculate your home’s equity, find the current market value of your home on sites like Zillow or Redfin. Remember that these sites only provide approximate data. If you have your home appraised, you can get a more accurate estimate, but you will need to pay for the cost of the appraisal.

Take the current market value of your home and subtract your current equity balance from it. You will find this on your monthly report and subtract any other loans you may have as collateral for your home. The number you get is the approximate value of the equity in your home.

Capital = home value – loan balance.

Capital = $350,000 – $150,000.

Capital = $200,000

How does housing equity work?

Creating housing equity is a bit like investing in long-term products such as bonds. Your money, for the most part, is trapped and cannot be spent.

There are several ways to use this asset, but it usually builds wealth over the years as “free and clear” home ownership increases. Capital appreciation is a long financial process, but more immediate market conditions can lead to dramatic break-even.

For example, a surge in home prices contributes to a significant increase in homeowners’ equity with mortgages across the country. According to data provided by CoreLogic, these homeowners have recorded about $3 trillion in capital gains since the second quarter of 2020, an increase of 29.3 percent over the same period last year. According to the National Association of Realtors, the average price of existing homes was $352,800 in September 2021, up 13.3 percent from a year earlier.

In the worst market, plummeting prices in home sales have reduced homeowners’ equity. During the Great Depression, for example, from the last quarter of 2008 through the first quarter of 2009, the average sales price fell by more than $14,000.

Why is housing equity important?

Housing equity can be a long-term strategy for wealth creation.

Buying a home is called a “forced savings account” because the mortgage reduces your debt while your home acquires value. This is different from all other assets purchased with a loan (such as a vehicle), which lose value on repayment. Your home will also become one of the most valuable assets you will own.

Many homeowners have increased their rates significantly over the past year. For example, at the end of the second quarter of 2020, more than one-third of U.S. properties with mortgages were considered “wealthy assets.” This means that debt to the property is less than 50 percent of the current market value of the home.

During the same period, only 4.1% of the nation’s mortgages were heavily foreclosed, and that’s with at least 25% more debt on the home than its appraised market value.

GIPHY App Key not set. Please check settings